Learning how to trade gold online can feel exciting at first, but that excitement often fades quickly once you’re actually in the market. Most beginner guides focus on surface-level advice, such as “buy low, sell high” or “watch the news,” but the truth is, trade in gold successfully requires more than just the basics. There are quiet truths about timing, emotion, and decision-making that rarely make it into beginner tutorials. These are the things experienced traders often learn the hard way, and wish someone had told them from the start.

Gold is a unique asset. It’s influenced by inflation, currency strength, global uncertainty, and even psychological factors that don’t always follow logic. That’s why trading requires a mix of discipline, strategy, and perspective. Jumping in too quickly or relying only on technical charts can lead to frustration or costly mistakes.

One of the smarter ways new traders gain clarity is by using reliable gold signals. These signals, when sourced from trusted providers, can offer valuable entry and exit points, helping you make better-informed decisions based on real market data rather than guesswork.

This blog isn’t about making trade in gold sound easy, because it’s not. Instead, it’s about making it clearer, more realistic, and more approachable for someone just getting started. If you’re serious about learning how to trade gold online the right way, you’ll want to go beyond the obvious. In the sections ahead, you’ll discover the often-unspoken insights that can help shape smarter decisions and more confident trades.

What Is Gold Trading?

Gold trading is the process of buying and selling gold with the aim of generating a profit from its price fluctuations. Unlike physically owning gold bars or jewelry, most gold trading today occurs online through financial instruments such as contracts for difference (CFDs), futures, exchange-traded funds (ETFs), or spot trading. This allows traders to guess on the price of gold without ever having to handle the metal itself.

Gold is considered a safe-haven asset, meaning it tends to hold its value during times of economic uncertainty or market volatility. That’s one reason it attracts investors and traders looking to protect their wealth or diversify their portfolio. However, gold prices aren’t static; they fluctuate based on various factors, including interest rates, inflation, currency fluctuations, geopolitical events, and central bank policies.

Online platforms have made it easier than ever to access the gold market, even with a small starting investment. Whether you’re trading short-term price movements or holding positions for longer periods, gold can offer both opportunity and risk.

It’s not just about watching the price rise or fall, successful gold trading requires thorough research to know how to trade gold in forex, the best gold trading strategy, and a comprehensive understanding of the broader financial industries.

Types of Gold Trading

When it comes to trading gold, there is no one size fits all approach. Different methods suit different trading styles, time commitments, and risk levels. Before learning how to trade gold in forex, it is important to understand the most common types of gold trading. Many traders are also exploring the SMC trading strategy, which focuses on market structure and price behavior. This method helps identify more precise entry and exit points, making it especially useful in the fast moving nature of gold trading.

1. Spot Trading

Spot trading involves buying or selling gold at its current market price, also known as the spot price. It is one of the simplest ways to trade and is often used by day traders or short term investors looking to benefit from immediate price movements. For many beginners, spot trading becomes a starting point when searching for the best gold trading strategy, as it allows them to learn market reactions in real time without long term commitments.

2. Futures Contracts

Futures are agreements to buy or sell gold at a predetermined price on a set future date. These contracts are traded on regulated exchanges and are popular among experienced traders. For anyone exploring how to trade in gold effectively, futures can be a powerful tool, offering significant profit potential. However, they also carry higher risk due to leverage and market volatility, making them better suited for those with a solid understanding of market dynamics.

3. Gold CFDs (Contracts for Difference)

CFDs allow traders to speculate on gold price movements without owning the physical asset. You can profit from both rising and falling markets, and it requires less capital compared to futures. For those exploring how to trade gold online, CFDs are a popular choice due to their flexibility, lower barriers to entry, and ease of access through most online trading platforms.

4. Gold ETFs (Exchange-Traded Funds)

Trade in gold ETFs, which are investment funds traded on stock exchanges that track the price of gold. They’re ideal for those who prefer a longer-term investment and want exposure to gold without directly having to trade in gold bullion or futures contracts.

5. Physical Gold Trading

Some traders still prefer buying and selling actual gold bars or coins. While this involves storage and security concerns, it appeals to investors who want to own a real asset and hold it as a hedge against inflation or currency risk.

What Affects The Prices Of Gold?

Gold may be a timeless asset, but its price is anything but fixed. It constantly shifts in response to various global factors. Understanding what influences the price of gold is key for anyone looking to trade it effectively. If you’re serious about learning how to trade gold in forex, it’s essential to grasp these core drivers before entering the market:

1. Inflation and Interest Rates

When inflation rises and money loses value, people often turn to gold because it tends to hold its worth over time. But when interest rates go up, gold may become less appealing since it doesn’t earn interest like savings accounts or bonds. So, both inflation and interest rates can influence gold prices. Understanding these shifts is essential for building the best gold trading strategy that adapts to changing economic conditions.

2. US Dollar Strength

Gold is priced in US dollars. If the dollar is strong, gold can become more expensive for international buyers, which may lower demand and prices. But when the dollar weakens, gold becomes cheaper for others to buy, often leading to higher demand and rising prices. The dollar’s movement plays a big role in gold trading, and understanding this relationship is crucial for anyone learning how to trade in gold effectively.

3. Geopolitical Tensions

During global conflicts, political instability, or financial crises, people often turn to gold as a safer investment. When things feel uncertain, gold is seen as a more secure place to hold value. As more people buy gold during these times, demand increases, which typically pushes the price up. One of the most practical gold trading tips is to monitor global events closely, as they often signal when gold demand and prices might rise.

4. Supply and Demand

Gold might not be used up like fuel but its supply still matters. If mining slows down or demand rises, for example through increased jewelry purchases or central banks increasing their reserves, prices can rise. If supply is high and demand drops, prices may fall. Like any market, gold responds to shifts in supply and demand. Understanding this balance is essential in gold trading for beginners who are learning how price movements work.

5. Market Sentiment and Speculation

Gold prices are also influenced by people’s perceptions of the market. News stories, social media, or sudden fear of economic trouble can cause quick reactions. Even without major changes in the real world, traders often move prices based on emotions or short-term expectations. For anyone learning how to trade in gold, it is important to recognize that market sentiment can be just as powerful as supply and demand. Being aware of emotional trading patterns can help in making smarter decisions.

Why Invest In Gold?

Now we are all aware of the factors that affect the gold price. Have you ever asked yourself why you invest in gold? If yes, then you also need to understand how to trade gold effectively to make the most of it. Gold has always been seen as something valuable, and that hasn’t changed even in today’s fast moving financial world.

While it may not provide regular income like dividends or interest, gold plays a crucial role in protecting your money during uncertain times. It helps maintain a steady investment when other parts of the market are unstable. Many modern traders also rely on tools like forex signals telegram groups to stay informed and make smarter gold trading decisions. Let’s look at why gold is still a smart choice for many investors.

1. Portfolio Diversification

One of the main reasons people invest and trade in gold is to balance their portfolio. Stocks, bonds, and real estate all fluctuate in line with the economy, but gold often exhibits a distinct behavior. When the stock market declines, gold usually maintains its value or even appreciates.

This makes it useful for reducing overall risk. Adding gold to your investments means you’re not putting all your money in one place, which can help protect you from significant losses when markets become volatile.

2. Inflation Hedge

Over time, the cost of living tends to rise. Groceries, rent, and fuel all add up. When prices rise and the value of money decreases, gold often maintains its value. That’s why it’s seen as a good hedge against inflation.

If your cash is losing buying power, holding some gold can help make sure your savings don’t lose too much value. It doesn’t grow like stocks, but it holds steady when the economy weakens. For those looking to take advantage of this stability in the financial markets, understanding how to trade gold in forex can be a smart move, especially during uncertain economic times.

3. Economic Turbulence

In times of economic trouble, such as recessions, financial crises, or global conflicts, people tend to shift their money into safer assets. Gold is one of the first places they look. It’s considered a safe haven because it doesn’t rely on the performance of any single company or government.

Even when the stock market crashes or currencies drop in value, gold usually remains stable. This makes it a strong backup when everything else feels uncertain. For those new to the market, understanding gold trading for beginners is key to taking advantage of gold’s stability during these unpredictable times.

4. Liquidity

Another great benefit of gold is its ease of sale. Whether you own physical gold or are trading it online, gold is widely accepted and in constant demand. If you ever need to turn your investment into cash, you can do it quickly.

Unlike some assets that can take weeks or months to sell, gold is highly liquid. This flexibility is especially helpful in emergencies or when sudden financial needs arise.

Who Buys Gold Maximum?

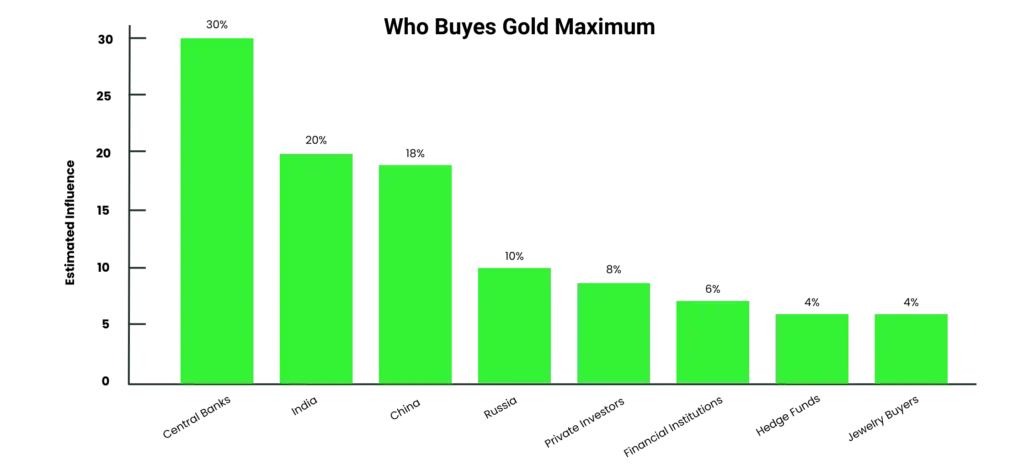

Gold is bought by a wide range of people and institutions, but some buyers stand out more than others. Central banks are among the biggest gold buyers in the world. They purchase gold to support their national reserves and protect against currency risks. Countries such as China, India, and Russia have been significant accumulators of gold in recent years. For traders, keeping an eye on central bank activity can be part of the best gold trading strategy, as their large purchases can impact global prices.

Apart from that, private investors, large financial institutions, and hedge funds also invest in gold, especially during times of economic uncertainty. In countries like India and China, people purchase gold mainly for jewelry and gifts, especially during festivals and weddings, daily. Whether it’s for cultural reasons, investment, or security, gold continues to attract interest worldwide.

How To Trade Gold Online?

Trade in gold online may seem complex at first, but once you understand the basic steps, it becomes much easier. Here’s a straightforward guide to help you know how to trade gold online. Many new traders also follow gold signals telegram channels to receive timely updates and insights that can guide their trading decisions. These signals can help simplify entry and exit points in the market.

1. Register With a Commodity Broker

The first step is to open an account with a registered commodity broker who offers access to gold trading. Look for a broker who is registered with SEBI (if you’re in India) and provides access to online platforms like MCX. The broker will verify your documents, after which you’ll receive login credentials for their trading platform.

2. Choose the MCX Platform

Gold trading is mainly done on the Multi Commodity Exchange (MCX). This platform allows traders to buy and sell gold contracts based on real-time prices. Through your broker, you can access the MCX and place trades online. MCX offers both small and large contracts, making it suitable for both beginners and experienced traders.

3. Pick a Suitable Contract Size

MCX offers different contract sizes to suit various budgets. You can choose from full-sized gold contracts (1 kg), mini gold (100 grams), or even micro contracts (10 grams). Beginners often start with smaller contracts to lower their risk while learning how the market works.

4. Deposit The Required Margin

To trade gold online, you don’t need to pay the full contract value upfront. You’ll need to deposit a margin, which is a percentage of the contract value, set by the exchange. This amount serves as a security deposit, allowing you to take a position in the market. Margins may change depending on market volatility.

5. Track Gold Prices Regularly

Before and after entering a trade, it’s important to keep an eye on gold prices. Prices can fluctuate due to various factors, including global news, currency movements, inflation data, and economic events. Most brokers offer real-time charts and news feeds, which can help you make informed decisions.

6. Trade Using Futures or Options

Gold trading is mostly done through futures or options contracts. Futures allow you to buy or sell gold at a fixed price on a future date. Options give you the right (but not the obligation) to do the same. These tools can be powerful, but they also carry risks, therefore, it’s wise to understand them before you begin.

7. Book Profits or Cut Losses

Once your trade is live, monitor it closely. If the price moves in your favor, you can book your profits. If the market moves against you, it’s equally important to cut losses early. Setting stop-loss and target levels before entering a trade can help you stay disciplined and avoid emotional decisions.

Gold Trading Tips For Beginners

Gold trading goes beyond watching price charts. It’s a combination of market awareness, timing, and understanding how gold fits into the broader global financial industry. If you’re new to it, these tips of gold trading for beginners will help you build good habits and spot smarter opportunities. Learning how to trade gold in forex can also give you an edge, as it helps you see how currency movements and global events impact gold prices.

1. Monitor ETF Flows as Leading Indicators for Gold Trading

Exchange-traded funds (ETFs), such as SPDR Gold Shares (GLD), hold substantial amounts of physical gold. When these funds see large inflows or outflows, it often signals shifts in investor sentiment. If money is flowing into gold ETFs, it suggests growing demand, which may lead to higher prices. Keeping an eye on ETF holdings can give you an early indication of market direction, before it fully appears in the charts.

2. Implement Volatility-Based Position Sizing

Gold can be highly volatile, especially during significant news events or periods of economic uncertainty. Instead of always using the same trade size, adjust it based on the amount of gold being traded. If volatility is high, reduce your position size to limit risk. If volatility is low, you can trade slightly larger positions. This method helps protect your account from big losses when the market becomes unpredictable.

3. Stay Geopolitically Aware

Gold often reacts strongly to global news. Wars, political instability, financial crises, and central bank decisions can cause prices to fluctuate rapidly. Even rumors or headlines can create sharp movements. As a trader, keep a close eye on global news, especially anything that creates fear or uncertainty. Gold is a safe-haven asset, so it typically rises when people are concerned about the economy or international stability.

4. Use Support/Resistance Zones with Volume

Support and resistance levels become more powerful when they’re confirmed by volume. If the price of gold bounces off a level with high trading volume, it’s a stronger signal than one with low volume. Volume shows how committed traders are at those levels. Combining basic chart zones with volume analysis helps improve your trade entries and avoids false signals.

5. Combine XAUUSD Analysis with Macro Trends

XAUUSD is the gold-to-US dollar pair most traders follow. But looking only at the short-term chart won’t give you the full picture. Consider the broader macroeconomic trends, including inflation data, interest rates, and central bank policies. When macro trends support your technical setup, your trades are more likely to succeed. For example, if inflation is rising and gold is near a support level, it may be a stronger buy signal.

6. Watch the Dollar Index (DXY)

Gold and the US dollar often move in opposite directions. When the dollar gets stronger, gold prices may fall. When the dollar weakens, gold usually rises. The Dollar Index (DXY) measures the strength of the US dollar against other major currencies. Watching the DXY alongside your gold chart can help you time your trades more effectively and avoid going against major market movements.

7. Trade XAUUSD at the Best Times of Day

The gold market is open nearly 24 hours a day, but not all times are equally active. The best times to trade gold are when major markets overlap, especially during the London-New York session, which typically occurs between 1:30 PM and 5:00 PM IST (8:00 AM and 12:00 PM GMT). This is when volume is highest, price moves are stronger, and spreads are tighter. Avoid trading during quiet hours unless you have a specific plan.

8. Don’t Fight the Gold Trend

Trying to go against the overall market direction is a common mistake for beginners. If gold is trending up, look for smart buy entries. If it’s trending down, focus on sell setups. Fighting the trend typically results in losses. Even if you think a reversal is coming, wait for a clear signal before acting. It’s better to trade with the flow of the market than to guess the turning point.

Best Gold Trading Strategies

There isn’t a one-size-fits-all way to trade gold, but the most effective strategies fall into two main categories: macro-based and technical. Some traders use one or the other, while many combine both to improve timing and decision-making. If you’re learning how to trade gold, understanding these strategies can help you make more informed choices. Below are strategies that experienced traders use consistently to find solid entries and manage risk more effectively.

1. Macro Trading Strategies

Gold is deeply tied to global economic conditions, especially interest rates, inflation, and central bank actions. If you understand what’s happening in the broader economy, you can anticipate big moves in gold before they even appear on the chart.

2. Real Yield Response

Gold tends to move in the opposite direction of real yields (interest rates adjusted for inflation). When real yields fall, gold usually rises, and when real yields rise, gold tends to drop. Traders watch U.S. 10-year Treasury yields minus inflation data to gauge this. A negative real yield environment supports gold, making it more attractive compared to fixed-income investments.

3. Central Bank Policy Tracking

Gold reacts strongly to central bank decisions, particularly those from the Federal Reserve, the European Central Bank, and the Bank of Japan. When interest rate hikes are paused or inflation concerns rise, gold tends to rally. Tracking the central bank’s tone, whether they’re “hawkish” or “dovish,” can provide early clues about where gold may head. Aligning your trades with policy shifts is a smart long-term play.

4. Technical Trading Strategies

While macro trends shape the big picture, technical analysis helps you time your trades effectively. Learning how to trade gold using technical strategies involves studying price charts, key levels, and repeating patterns to identify smart entries and exits. This approach gives traders a clearer sense of when to act, especially during volatile market conditions.

5. Breakout Gold Trading

Gold often trades within clear support and resistance zones before breaking out of them. When price breaks out of a tight range with strong volume, it’s often the start of a sharp move. Breakout traders wait for confirmation, a close outside the range, or a retest of the breakout level, before entering. It’s useful during volatile market phases or after big news events.

6. Trade in Gold Price Pullbacks

Instead of chasing gold after it moves strongly in one direction, this strategy waits for a small retracement, or “pullback,” to a key level, such as a moving average, previous resistance, or trendline. If gold is in an uptrend, look for a dip to buy. If it’s in a downtrend, look for a bounce to sell. Pullback trading helps you enter with better prices and manage risk more effectively.

7. Using the Gold-Silver Ratio to Trade Gold

The gold-silver ratio compares the price of gold to silver. When this ratio gets unusually high, it often signals that gold is overvalued relative to silver, and vice versa. Traders use this ratio to look for potential turning points or relative strength between the two metals. While it’s not a direct buy/sell signal, it’s a valuable tool to support your gold outlook, especially when combined with other indicators.

Day Trading Gold: Step By Step Strategy Breakdown

Day trading gold, particularly through the XAUUSD pair, is all about timing, precision, and risk management. The best gold trading strategy often focuses on identifying breakout opportunities after consolidation, confirmed by volume and clean support/resistance zones. Many traders also rely on the best forex signals to stay ahead of market moves and improve their chances of success. Here’s how to approach it step by step:

1. Identify Key Support and Resistance Levels

Before anything else, mark out major support and resistance zones on your chart. These are areas where gold prices have repeatedly bounced or reversed, indicating potential opportunities for traders.

Use 15-minute and 1-hour timeframes to draw clear horizontal levels. These zones act as “decision areas” where prices are likely to react. Avoid trading in the middle of the range. Wait until price approaches these key zones. Well-defined levels enable you to plan entries and exits with greater accuracy.

2. Wait for Gold Price Consolidation

Consolidation means price is moving sideways in a tight range, often just below resistance or above support. This “cooling off” period builds pressure and often leads to sharp breakouts. Understanding how to trade gold during these phases can significantly improve your timing.

Instead of jumping in too early, wait for the price to settle into a narrow zone. Think of it as the market taking a deep breath before making its next big move. Breakouts from consolidation often occur with strong momentum, making them ideal for short-term trades.

3. Perform Volume Analysis for Confirmation

Volume helps confirm whether a breakout is real or likely to fail. If gold breaks out of consolidation with strong volume, it shows that many traders are participating, which supports the move. But if volume is low, the breakout might be a fake-out.

Use volume indicators, such as On-Balance Volume (OBV), or simply visually observe the volume bars. Ideally, you want to see a volume spike during or just before the breakout candle.

4. Enter the XAUUSD Trade on Confirmed Breakout

Once you spot a breakout from your range and volume supports it, look to enter the trade. You can join immediately after the breakout candle closes or wait for a retest of the breakout level for extra confirmation.

For example, if price breaks resistance, a retest and bounce off that resistance (now turned support) gives a safer entry. Always check for fakeouts by waiting for a solid close beyond the level. Don’t rush in on the first spike.

5. Set Risk Management Parameters

Never enter a trade without knowing where to exit. Place your stop-loss just below the last support if buying, or above the previous resistance if selling. Define your take-profit based on recent highs/lows or use a risk-to-reward ratio of 1:2 or better.

This means risking $10 to make $20. Risk only a small portion of your trading account; a limit of 1 to 2% per trade is a smart choice for beginners. Managing your downside is what keeps you in the game in the long term.

The Final Thoughts

Stepping into the world of trading and being aware of how to trade gold online is a bold move, especially when you’re just starting out. While gold has a reputation for being stable, the market around it is anything but predictable. That’s why knowing how to trade gold the right way involves more than reading charts or chasing trends. It means developing patience, understanding global events, and learning to trust your process without being swayed by every price swing.

The lessons we’ve explored here aren’t flashy tricks or one-size-fits-all strategies. They’re real insights, drawn from the experiences of traders who’ve taken the hits and figured out what really works. If there’s one takeaway, it’s that trade in gold isn’t about being perfect. It’s about being prepared. The sooner you learn to think long-term, manage risk wisely, and keep your emotions in check, the faster you’ll start seeing real progress.

No one gets it right every time, and that’s okay. What matters is that you keep learning, stay grounded, and treat every trade as a chance to grow. Whether you’re aiming to supplement your income or explore a new financial skill, trade in gold online can be rewarding if you approach it with clarity, consistency, and a clear head.

[…] success with gold forex signals requires discipline. Traders must know how to trade gold and avoid blind dependence, respect stop-loss levels, and only trust providers with proven results. […]

[…] gold trading signals are designed for more active trading and every trader should know about how to trade gold. These signals are generated using a combination of technical indicators, market sentiment […]