Navigating the forex market without a clear strategy can feel overwhelming, especially with rapid price movements and global economic shifts happening around the clock. That’s where the best forex signals come into play. Whether you’re just starting out or have years of experience under your belt, high-quality signals can help you identify smarter entry and exit points, reducing the guesswork in your trades.

In 2025, the demand for reliable signal services is growing, and traders now have access to more choices than ever. From fully automated alerts to analyst-backed setups, the range of available options is impressive. But with that abundance comes the challenge of finding trustworthy sources. Many still wonder if forex trading signals free are worth considering, or if premium services really offer an edge.

In this blog, we’ll explore the top-performing signals available right now, review the best forex signal providers 2025, including those offering gold signals, and highlight swing trading strategies that work across different market conditions.

Whether you’re trading full-time or just a few hours a week, there’s something here to sharpen your edge in the market.

Understanding Best Forex Signals

If you’re new to the world of forex trading or even just looking to sharpen your strategy, understanding the best forex signals is a crucial first step. These signals are essentially trading suggestions that indicate when to buy or sell a currency pair, along with key details such as entry points, stop-loss levels, and take-profit targets.

But forex signals aren’t just random tips; they’re based on detailed market analysis, often using a combination of technical indicators, fundamental data, and real-time price action. Some signals originate from experienced analysts, while advanced trading algorithms generate others.

A Typical Forex Signal Includes:

- The currency pair (e.g., GBP/USD)

- Trade direction (buy or sell)

- Entry price

- Stop-loss level

- Take-profit level

Signals are designed to remove emotion from trading and help you act based on strategy rather than impulse. Whether you’re following a free Telegram group for forex trading or subscribing to a premium service, the key is to ensure you understand how each signal fits within your overall risk management and trading goals.

Taking the time to learn how signals work will help you trade with more confidence and discipline.

Key Insights on Forex Signals Based on Real Data

1. Most new traders depend on forex signals

A report from Forex School Online in 2023 showed that more than 90% of beginner forex traders use signal services during their first few months. This shows just how much traders rely on expert guidance when starting out.

2. Telegram is the top platform for forex signal delivery

A study published in 2024 on Statista found that nearly 65% of all forex signal providers send their trading updates through Telegram. Its real time alerts and ease of use make it a preferred option for both traders and providers.

3. Swing trading signals give better long term results

According to a recent post on BabyPips, swing trading signals often lead to stronger long term profits than scalping or intraday signals. This makes them ideal for people who cannot monitor the charts all day.

4. Gold trading signals are among the most popular

Myfxbook released data in 2024 showing that trades based on gold signals, especially for the XAUUSD pair, made up 32% of all signal driven forex trades. This shows the growing interest in commodities like gold.

5. Not all forex signal providers offer the same performance

Forex Verified tracks various providers and reports accuracy levels ranging from 40 to 85%. These differences depend on their trading style, analysis methods, and how they manage risk in different market conditions.

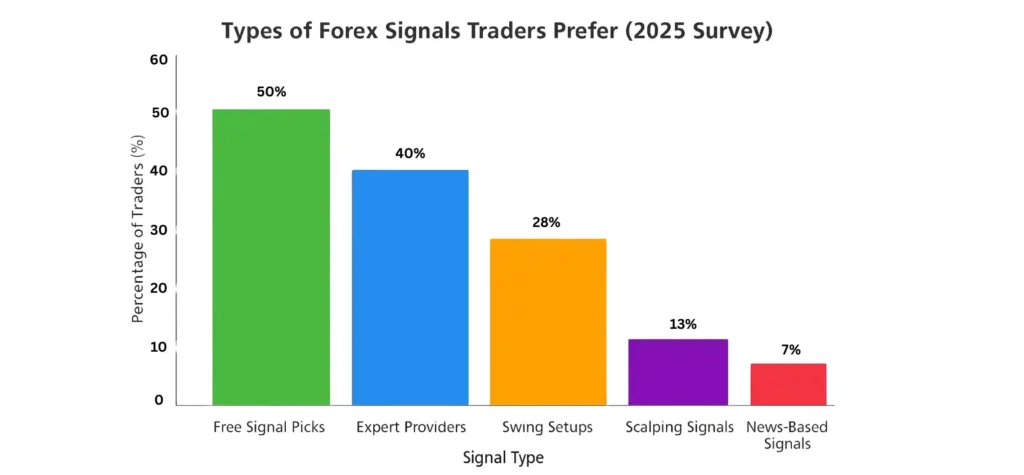

Types of Best Forex Signals Traders Prefer (2025 Survey)

If you are looking for the best forex signals in 2025, the right signals can truly improve your trading results whether you are a beginner or an expert. This chart highlights trader preferences among forex swing trading signals, expert-paid providers, and forex trading signals free of cost.

With the rise of real-time analytics and AI-driven strategies, traders are now adopting smarter approaches to capitalize on market trends. From short-term scalping to reliable swing setups, every method has its followers.

Review the data below to see which signal types are gaining the trust of winning traders and how you can select the best forex signals fit for your strategy.

How to Understand Forex Trading Signals?

If you’ve ever looked at forex signals and felt unsure about what they really mean, you’re not alone. At first glance, signals can look like a string of numbers and trading jargon. But once you break them down, they’re actually straightforward and incredibly useful for making smarter trading decisions.

A typical forex trading signal includes a few key components:

- Currency Pair: This tells you which two currencies are involved in the trade, such as EUR/USD or GBP/JPY.

- Entry Price: The price at which the trade should be opened. This is where you enter the market.

- Stop Loss (SL): A risk management tool that automatically closes the trade if the price moves too far against you. It helps protect your account from major losses.

- Take Profit (TP): This sets a target price to lock in profits when the market moves in your favor.

- Direction (Buy/Sell): Tells you whether to go long (buy) or short (sell) based on market analysis.

Understanding these elements will help you execute trades more confidently, whether you’re following free forex trading signals or signals from the best forex signal providers 2025. Always pair signals with your own market awareness and never rely blindly on any source.

According to Wikipedia, forex signals are essential tools in online currency trading, especially for those who want to follow the market without constant monitoring. They add structure to your trading plan and reduce emotional decision-making.

Nearly 70 percent of retail forex traders rely on some form of signal-based trading, and signal providers have become a $500 million market globally. Platforms that offer accurate and timely signals report up to 60 to 75 percent trade success rates, especially when signals are used with strong risk management.

How are Forex Signals Generated?

Forex signals aren’t pulled from thin air, they’re the result of careful analysis, strategic thinking, and sometimes even advanced technology. Understanding how these signals are generated gives you better insight into their reliability and how they can support your trading decisions.

There are generally two main sources behind the best forex signals generation:

1. Human Analysis

Experienced traders and analysts study the market using a mix of technical and fundamental analysis.

- Technical Analysis: It involves reading price charts, identifying patterns, and utilizing indicators such as RSI, MACD, or moving averages.

- Fundamental Analysis: It focuses on news events, interest rate changes, economic reports, and political developments that impact currency strength.

These experts use their knowledge and trading strategies to issue signals based on their market outlook.

2. Automated Algorithms

Some signal providers use automated systems or trading bots that analyze market conditions around the clock. These algorithms scan for trade setups using pre-programmed rules and technical indicators. They’re fast, emotion-free, and often ideal for high-frequency trading strategies.

Whether human-generated or algorithm-based, the best forex signals come from sources that prioritize accuracy, consistency, and risk management. Always look for providers who explain their method and share a track record of real results.

Forex Trading Signals Free: Are They Worth It?

When you’re starting out in forex trading or looking to test new strategies without much risk, free forex trading signals seem like a perfect solution. But are they actually worth your time and trust?

Free signals can be a great stepping stone, especially for beginners who want to learn how trade setups work in real-time. These signals typically include basic trade information, such as the currency pair, entry point, stop-loss level, and take-profit level. However, the depth of analysis and accuracy can vary depending on the source.

Here are a few popular free signal providers in 2025 that traders are turning to:

- Gold Signal: Provides speed, accuracy, & transparency, and also gives a free VIP lifetime access option.

- ForexSignals.io: Offers a free Telegram group where traders receive alerts based on both technical and fundamental analysis.

- Learn2Trade: Provides limited free signals each day, with additional insights and setups available through their premium plans.

- FXLeaders: Known for its website-based alerts, covering major currency pairs along with technical charts and market commentary.

Free signals can be helpful, but they should be treated as learning tools rather than guaranteed profit-makers. Always test them on a demo account and combine them with your own market knowledge before trading live.

Best Forex Signal Providers 2025

With dozens of forex signal providers competing for attention, it can be hard to know which ones truly deliver results. To make your decision easier, we’ve compared some of the best forex signal providers 2025 based on reliability, performance, pricing, and user experience.

Whether you’re looking for free options or premium services, this table highlights the top choices trusted by traders this year.

Best Forex Signals | Key Features |

Gold Signal | Speed, Accuracy & Transparency, and Free VIP Lifetime Access Option |

ForexSignals.com | Live trading room, expert analysis |

Learn2Trade | Daily signals, swing & scalping strategies |

1000pip Builder | Verified results, automated email alerts |

FX Premiere | Free + premium options, global coverage |

Forex Swing Trading Signals

If you prefer a slower, more calculated trading approach, swing trading might be your style. Unlike scalping or day trading, Forex swing trading signals aim to capture price movements that unfold over several days or even weeks. And with the right forex swing trading signals, it becomes much easier to identify high-probability setups without constantly monitoring the charts.

Swing trading signals are typically based on higher timeframes, such as the 4-hour or daily chart. They focus on key levels, such as support and resistance, trendlines, and confirmation from technical indicators like moving averages, RSI, or MACD. These signals provide you with sufficient time to plan your entry and manage your risk effectively.

Some of the best Forex swing trading signals sources in 2025 include:

- DailyForex: Offers well-explained signals with market analysis tailored for medium-term traders.

- TradingView Analysts: Independent traders post detailed swing setups, complete with chart visuals and explanations.

- MyFxBook Community Signals: Aggregates signals and strategies from real traders, allowing you to filter by performance and style.

Forex swing trading signals are most effective for those who prefer a balanced, strategic, low-stress approach that is grounded in strong technical logic.

Comparison Chart: Best Forex Swing Trading Signal Sources (2025)

Provider | Platform | Signal Type |

DailyForex | Website & App | Analyst-curated swing trades |

TradingView Analysts | TradingView Web/App | User-posted swing setups |

MyFxBook Signals | MyFxBook Platform | Community-driven strategies |

How to Choose the Right and Best Forex Signals Provider?

With so many forex signal services available today, choosing the best forex signals can feel like finding a needle in a haystack. Whether you’re trading full-time or just starting out, it’s essential to align with a provider that aligns with your trading goals, risk tolerance, and preferred trading style.

Here are a few key factors to consider before subscribing to any signal service:

Transparency

A reputable provider should always share past performance, ideally with verified results. Look for transparency around win rates, drawdowns, and historical trades. If they’re hiding their track record, that’s a red flag.

Delivery Method

How you receive signals matters. Some providers send alerts via Telegram, others use email, SMS, or even in-app notifications. Select a method that suits your lifestyle and enables you to respond promptly when a trade alert is triggered.

Support & Education

The best forex signal providers offer more than just signals. They provide context, trade breakdowns, and even community support. If a service only gives you numbers with no explanation, you’re left trading blind.

Strategy Match

Not all signals suit every trader. Some services specialize in scalping, while others focus on swing trading or long-term setups. Make sure their strategy matches your preferred timeframe and trading style.

Taking the time to vet a provider can save you from costly mistakes and help you build confidence in your trading decisions.

The Final Thoughts

The search for the best forex signals doesn’t have to be a guessing game. With so many tools and services available in 2025, traders now have the opportunity to work smarter, not harder. From forex trading signals free that offer a great starting point, to premium providers with proven track records, the key lies in choosing a service that aligns with your style and trading goals.

No matter where you are in your trading journey, a good signal provider should offer more than just alerts. It should provide consistency, clarity, and confidence. Some traders find value in community-based platforms or Telegram groups, while others prefer signals backed by deep technical and fundamental analysis. The beauty of today’s forex environment is that you’re not limited to just one approach.

We’ve covered a mix of top-rated services, strategy-based setups like swing trading, and essential tips to help you make informed decisions. Whether you lean toward automation or hands-on analysis, the right signals can help you make the most of every trade. Stay curious, stay informed, and let the right signals guide your path to smarter trading.

[…] 2025, best forex signals have become more valuable than ever due to record-high gold prices, global economic uncertainty, […]