In forex trading, it’s easy to get caught up in signals, indicators, and systems that promise big results. But the truth is, most of these tools don’t show what really matters. Behind every candle and price movement, there’s a pattern to how large financial players operate. This is where the SMC trading strategy comes into play.

Instead of focusing on surface-level moves, it helps traders understand the deeper mechanics of how institutions actually move the market. These are the players with real influence, and SMC trading strategy leaves subtle clues behind, if you know where to look.

SMC strategy is all about reading price action with more clarity. You will come across terms like order blocks, break of structure, and fair value gaps. While they may sound complex at first, they all serve one purpose: helping you trade in sync with the smart money.

In this guide, we’ll explore the core ideas behind SMC and how they apply specifically to forex trading. Whether you’re new to trading or refining your skills, you’ll gain a fresh perspective on what the market is really telling you, and how to respond with more confidence.

What is SMC in Forex Trading?

In forex trading, SMC stands for Smart Money Concepts. It’s a trading approach based on how large institutions, such as banks and hedge funds, actually move and manipulate the market to fulfill their massive orders.

Unlike retail traders who often chase trends or rely on lagging indicators, smart money follows a plan. They create liquidity, trigger retail emotions, and execute trades in areas that most traders ignore.

SMC is built around the idea that the market isn’t random. Price doesn’t just go up or down without reason. Every spike, drop, or sideways move often has a purpose, and it’s usually tied to where smart money wants to enter or exit positions.

Rather than focusing on traditional setups, SMC in trading helps traders read price action through a different lens. It emphasizes market structure, liquidity zones, order blocks, and other key elements that point to institutional activity. By understanding how smart money operates, traders can avoid common pitfalls and begin searching for high-probability setups that align with the actual market flow.

In short, SMC in forex trading isn’t just another strategy, it’s a way to shift your mindset and start thinking like the professionals who truly move the markets.

Smart Money Concepts

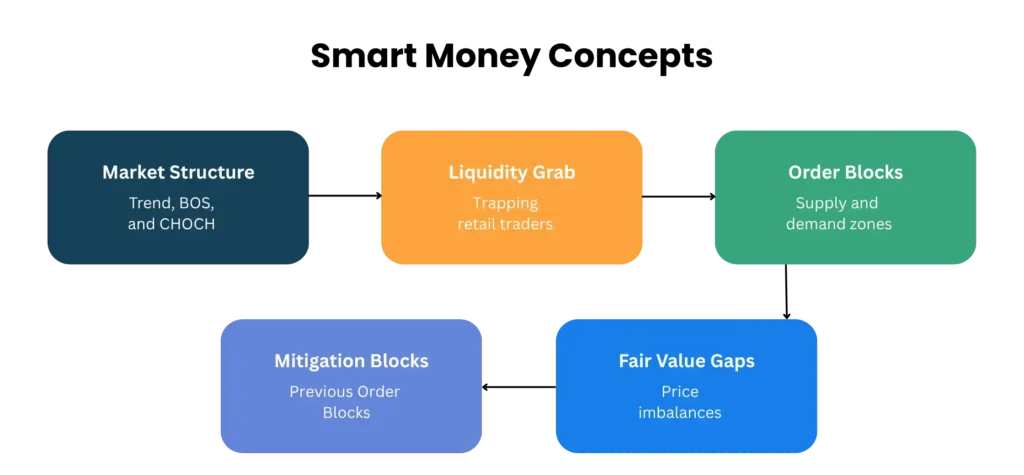

Smart Money Concepts represent a deeper way of reading the market, through the lens of the institutions that control large volumes of capital. These concepts are not based on traditional indicators, but rather on market structure and price behavior that reflect how smart money enters and exits trades.

Understanding these concepts helps you avoid false signals and align your trades with the genuine momentum driving the market. When combined with reliable gold signals, Smart Money Concepts can give traders an even clearer edge, especially in volatile markets like XAUUSD.

Let’s break down the core elements of SMC in trading.

1. Order Blocks (OB)

Order blocks are zones where large buy or sell orders were placed by institutions. These areas typically appear before a strong market move and serve as footprints left behind by astute investors.

When prices return to these zones, they often react again, either reversing or continuing, because unfilled orders may still be resting in these areas. Order blocks are key levels for identifying potential entries or exits based on institutional interest.

Example: On a 4‑hour chart of EUR/USD, you might see a bearish candle just before a big recovery. That bearish candle’s open and close define your bullish OB. Price often returns to that zone, gives a reaction, then resumes upward.

How to trade it: Mark the OB on higher timeframes (H4 or Daily) and wait for price to revisit. Confirm with a rejection wick or reversal candlestick before entering. Stop-loss goes just beyond the zone, take profit at the next structure high.

2. Breaker Blocks

Breaker blocks are similar to order blocks, but they form when price invalidates a previous structure. They appear after a failed support or resistance level gets broken and then retested.

A breaker block becomes significant because it shows where smart money absorbed liquidity, broke through, and then used that same area as a launchpad. Traders use breaker blocks to spot reversals or strong continuation zones.

How to trade it: Wait for price to break a key support or resistance level. Mark the breaker block zone and watch for a retest. Enter after a clear rejection or confirmation candle has formed. Stop-loss goes beyond the zone; target the next structure level.

3. Fair Value Gaps (FVG)

A fair value gap is a price imbalance created when the market moves too quickly, leaving a gap between candles. These gaps often occur during periods of strong buying or selling pressure, and the price tends to revisit them later to “rebalance” the market.

Think of FVGs as a sign that the market moved away from fair value, and smart money may return to that level before continuing the trend.

How to trade it: Identify a clean, fair value gap on a higher time frame. Wait for price to retrace into the gap. Look for confirmation, such as a rejection wick or BOS. Enter with tight risk; target previous highs or lows.

4. Break of Structure (BOS)

The break of structure occurs when price breaks a previous high or low that marked a key swing in the trend. It signals a potential shift in market direction or confirmation of a trend continuation.

BOS is one of the most important elements in SMC strategy, as it helps traders confirm that momentum is aligned with their setup. It also guides entries and helps validate order blocks and FVGs.

How to trade it: Spot a BOS to confirm trend direction. Use it to align with bias, long after a bullish BOS, short after a bearish one. Combine it with order blocks or FVGs for entry and manage risk below recent structure.

5. Change of Character (Choch)

A change of character is the earliest clue that a trend may be reversing. It happens when price breaks the internal structure of a trend, usually before the official BOS. For example, in an uptrend, a Choch would be a lower low that disrupts the bullish pattern.

It’s an early warning signal that smart money may be shifting direction, and traders should prepare for a new phase in market behavior.

How to trade it: Choch is an early signal, not an entry by itself. Wait for a Choch, then watch for a BOS in the new direction. Use that shift to frame entries at order blocks or FVGs with smart money alignment.

6. Liquidity

In SMC trading strategy, liquidity refers to areas where stop-losses, pending orders, or trapped traders are likely to be present. These zones are often targeted by institutions, not avoided. Why? Because they need liquidity to fill large orders.

That’s why price often spikes above highs or below lows before making a real move. Understanding where liquidity lies helps traders anticipate these traps and avoid becoming a part of them.

How to trade it: Identify liquidity above highs or below lows. Expect smart money to target these zones. Enter only after liquidity is swept and price shows a reversal pattern or BOS. Avoid entries near untouched liquidity unless it’s part of your setup.

How do All These Concepts Work Together?

- Identify the market structure and overall trend.

- Spot a valid Order Block with a confirming Fair Value Gap and/or Breaker Block.

- Use BOS or Choch to confirm structure bias.

- Map out liquidity zones around swing highs or lows.

- Wait for price to retrace into OB or FVG, preferably within a liquidity zone.

- Look for a reaction candle, rejection, engulfing, or BOS, for entry.

- Place stop-loss just beyond the zone and target the next OB or structure level.

How Does The SMC Trading Strategy Work?

The SMC trading strategy works by following the footprints of institutional traders, those who have the size and influence to move the market. Instead of reacting to lagging indicators, Smart Money Concepts focuses on understanding the natural flow of price, market structure, and liquidity. For traders seeking more clarity or confirmation, especially when filtering entries, using insights from the best forex signals providers can support decisions grounded in SMC, helping align trades with broader market movements.

SMC strategy doesn’t chase the market. It patiently builds positions where retail traders are most likely to make mistakes, at stop-loss zones, breakout traps, and obvious highs or lows. These areas provide the liquidity that large players require to execute substantial trades.

The strategy involves identifying market structure shifts (like Break of Structure and Change of Character), locating Order Blocks or Fair Value Gaps, and watching for liquidity grabs before real moves begin. SMC in trading waits for the market to reveal its intent, then acts with precision and discipline, trading with the trend, not against it.

By understanding where smart money enters and exits, traders can make higher-probability decisions, minimize emotional mistakes, and trade with a clearer sense of direction.

Supply and Demand

In the SMC strategy, supply and demand zones are areas where smart money has entered the market in large volumes. Supply zones form before strong downward moves (institutional selling), while demand zones precede powerful rallies (institutional buying).

Order blocks often mark these areas, and price frequently returns to them for retests. Trading from these zones aligns your entry with where the market previously reacted with strength.

Price Patterns

While Smart Money Concepts doesn’t rely on classic retail patterns like head-and-shoulders or double tops, it does recognize behavioral patterns that repeat around liquidity zones, such as liquidity sweeps, stop hunts, and false breakouts.

These patterns show where retail traders get trapped and smart money steps in. Recognizing them helps you anticipate entries and avoid falling into common market traps.

Support and Resistance

In traditional trading, support and resistance are seen as static lines. In the SMC trading strategy, these zones are viewed as liquidity pools, where stop-losses and pending orders are concentrated. Smart money often pushes price just beyond these levels to trigger retail stops and collect liquidity before moving in the true direction.

This is why understanding how price behaves around support and resistance is more valuable than blindly reacting to them.

How to Trade with the SMC Trading Strategy?

SMC trading strategy isn’t about jumping into the market whenever a candle looks strong. It’s about observing, waiting, and aligning your trades with the flow of institutional activity. Many traders also keep an eye on gold signals Telegram channels to stay updated on potential XAUUSD moves while applying SMC principles. Here’s a simple step-by-step approach to applying this strategy in real market conditions.

Step 1: Determine the Trend

Before anything else, you need to know where the market is going. Is it making higher highs and higher lows? That’s an uptrend. Lower highs and lower lows? That’s a downtrend. If the market is stuck in a range, stay patient.

You can determine the trend by looking at the market structure on a higher timeframe (like the 4H or Daily). In SMC strategy, trend is confirmed with a Break of Structure (BOS). A bullish BOS signals the continuation of an uptrend, while a bearish BOS confirms a downtrend. Always trade in the direction of the smart money flow.

Step 2: Identify a High-Probability Order Block

Once the trend is clear, the next step is to identify a key area where smart money is likely to have entered the market. This is called an Order Block, typically the last opposite-colored candle before a strong move.

In a bullish trend, look for the last bearish candle before a sharp move up. That candle becomes your bullish order block. In a downtrend, find the previous bullish candle before a big drop, which becomes your bearish OB.

Mark the open and close of the candle, extend the zone forward, and wait for price to return. A reaction in that zone often signals institutional interest, especially if it aligns with a Fair Value Gap (FVG) or liquidity zone.

Step 3: Determine Your Entry and Exit Points

When price returns to the order block, it’s time to prepare your trade. But don’t enter blindly. Wait for confirmation, such as a Change of Character (Choch) or a minor break in structure in your direction on a shorter timeframe (like the 15M or 5M).

For the entry, look for a strong rejection wick, bullish/bearish engulfing candle, or internal BOS. Enter once the move is confirmed. Set your stop-loss just outside the order block. This keeps your risk tight while protecting you from normal market noise.

Your take-profit can be placed at the next significant structure point, liquidity level, or opposing order block. Always manage your risk-to-reward ratio, ideally aiming for a ratio of 1:2 or higher.

Smart Money Concepts PDF

We have put together an easy-to-understand SMC Concept PDF guide on SMC in trading. It explains the main ideas and steps so you can learn how to trade like the big players.

You can download the SMC concept PDF below and use it as a handy guide while trading. It’s a great way to get familiar with the strategy and improve your skills.

What’s the Difference Between Smart Money Concepts and Price Action?

While both Smart Money Concepts and Price Action focus on understanding price movement without relying on indicators, they approach the market in different ways.

Price Action emphasizes patterns and structure, while SMC goes deeper into the intention behind price, specifically how institutions manipulate liquidity and trap retail traders.

Below is a simple table that outlines the core differences between the two approaches:

Aspect | Smart Money Concepts (SMC) | Price Action |

Focus | Institutional behavior and liquidity | Candlestick patterns and market structure |

Key Concepts | Order blocks, liquidity grabs, BOS, FVG | Support/resistance, trendlines, chart patterns |

Market View | Behind-the-scenes activity of big players | What is visible on the chart |

Tools Used | Market structure shifts, supply/demand zones | Wicks, price levels, trend formations |

Entry Style | After liquidity sweeps or structural confirmation | After breakout, retest, or reversal patterns |

Target Audience | Traders aiming to follow institutional footprints | Traders who read raw price behavior |

Complexity | Higher learning curve, deeper analysis | More straightforward and beginner-friendly |

Is the SMC a Good or Bad Trading Method?

The SMC trading strategy is neither purely good nor bad; it depends on how well it’s understood and applied. For disciplined traders who are patient and committed to learning, SMC offers a detailed and structured way to trade in alignment with how institutions operate.

It gives insight into price movement that goes beyond basic technical analysis. However, for traders seeking quick setups without in-depth analysis, it can feel overwhelming or too complex.

Like any other strategy, SMC trading strategy also works best when paired with sound risk management, experience, and a clear trading plan. Below are the main advantages and drawbacks to help you decide if this approach fits your style.

Pros Of SMC Trading Strategy

Aligns with Institutional Moves: Helps traders follow where real market momentum originates, big banks and institutions.

Avoids Retail Traps: SMC trading strategy helps to reduce the likelihood of falling for false breakouts or stop hunts commonly found in retail trading.

High Reward-to-Risk Potential: When applied correctly, setups often offer favorable risk management opportunities.

Focus on Market Structure: Encourages a deeper understanding of price flow rather than relying on lagging indicators.

Versatile Across Timeframes: The SMC strategy is effective on both higher and lower timeframes, making it suitable for a range of trading styles.

Cons Of SMC Trading Strategy

Steep Learning Curve: Requires patience and dedication to fully grasp concepts such as order blocks, liquidity, and structural shifts.

Complex for Beginners: SMC trading strategy can feel overwhelming without solid foundational knowledge of price action and market behavior.

Needs Confirmation: Trades often require additional signals for confirmation, which may delay entries.

Not a Quick Fix: Success with the SMC strategy comes from consistent practice, not instant results.

Potential for Misinterpretation: Without experience, traders may misread zones or signals, leading to losses.

How Profitable is the Smart Money Concept?

The SMC trading strategy is a highly effective technique that focuses on following the actions of institutional traders, also known as “smart money.” This strategy can be profitable, but with significant caveats such as:

Why It Can Be Profitable

- Institutional Insight: Smart Money Concepts aims to align retail trades with institutions (banks, hedge funds), which generally move markets. Trading in their direction can offer higher probability setups.

- Market Structure Awareness: The SMC strategy emphasizes understanding market structure (e.g., BOS – Break of Structure, CHoCH – Change of Character), liquidity zones, and order blocks, which offer better timing and precision.

- Risk Management Focus: Many SMC strategies stress low-risk entries and tight stop-losses around high-probability zones (like mitigation blocks), improving the reward-to-risk ratio.

- Scalability: SMC trading strategy can be applied to various timeframes and asset classes (forex, indices, cryptocurrencies, etc.), making it a versatile tool.

Why It’s Not a Guaranteed Goldmine

- Highly Subjective: Order blocks, liquidity grabs, and inducements can be interpreted differently by traders. Two traders may draw different conclusions from the same chart.

- Complex and Overhyped: Many courses and influencers overcomplicate SMC or sell it as a “holy grail,” which it is not. Execution requires skill, experience, and discipline.

- Lack of Verified Track Records: Most online SMC trading strategy claims aren’t backed by third-party, verified results (such as MyFXBook or FTMO). Be cautious about profitability claims unless independently verified.

- Low Win Rate if Misapplied: Without proper backtesting and risk management, traders often over-leverage and chase trades, resulting in significant losses.

Realistic Profitability Expectations

If applied with proper discipline, SMC trading strategy could yield:

- 10 to 30% monthly returns (on average, for high-probability setups using small risk per trade, like 1%)

But with significant drawdowns if poorly managed.

Consistent profitability comes more from than just the strategy itself:

- Strategy + Risk Management

- Emotional control

- Market experience

In short, Smart Money Concepts can be profitable, but:

- It’s not beginner-friendly.

- It demands rigorous backtesting, practice, and a deep understanding of price action.

- The trader’s skill matters more than the strategy’s theoretical edge.

The Final Thoughts

Trading is often described as a battle between the informed and the unaware. The SMC trading strategy gives you a chance to step onto the side that understands what’s really happening behind the scenes. By learning how smart money positions itself in the market, you’re no longer trading with guesswork; you’re making decisions based on logic and structure. For many traders, combining this approach with insights gained from forex signals Telegram channels can offer additional clarity and support in identifying high probability setups.

The beauty of this approach is in its simplicity once you get past the surface. Concepts like order blocks, liquidity zones, and break of structure aren’t just terms, they represent real activity from major market players. When you learn to recognize these patterns, everything begins to make more sense.

That doesn’t mean it’s a shortcut to instant success. Like any skill, trading with SMC takes time, observation, and discipline. But it offers a framework that cuts through the noise and helps you focus on what truly matters.

In the end, the goal is not to predict every move, but to understand why the market moves the way it does. And with Smart Money Concepts, you’re learning to see the market through a sharper lens, one that can guide your trades with greater purpose and clarity.

[…] looking at basic trendlines, our team at ForexGoldSignal has identified the institutional “Smart Money” footprints that suggest we are only in the middle innings of this historic bull […]